Sitting back in my chair and typing away at the keyboard, I reflect on some of the hard-won lessons that have shaped my line of thinking over the years. One recurring theme that stands out is how an individual experience is a much stronger learning tool than a series of lectures or time spent studying a subject. For instance, its likely that as a small child your parents told you that the stove was hot and not to be touched. Despite this verbal warning, your curious mind was relentlessly drawn to the smell of what ever was cooking, pulling you closer and closer, only to once again be buffeted by their warnings in an almost predictable cycle. Eventually, the desire to be close and give it a touch is usually too strong to avoid, and when their ever-present gaze falters, your curiosity gives in.

The reward for this behavior? You likely get burned. But you also get a lesson through experience, not to touch it again. Suddenly your parents would find their verbal deterrence was no longer required and you would maintain a reasonable distance.

Our society today is inundated more than ever with advertisements and sales tactics that are arguably some of the most successful in history. Luck is no longer a large determining factor relative to a successful sale. Studies are conducted to understand how our brains work, how we think, and what methods can be leveraged to take advantage of our subconscious and trigger our underlying fears, curiosities, or hopes and dreams. All of this research just, to to facilitate a sale. Not surprisingly, the indirect success of these tactics can be seen through the ever increasing consumer debt numbers, a near continuous bombardment of advertisements, and stories of the average American unable to come up with a $600 in an emergency.

For those on the path to FI, this means our long road is paved with land-mines and pitfalls designed to separate us from our hard earned (and hard saved) dollars. Travel long enough, and you are bound to hit a few bumpy areas. I make this statement from experience and as a result, have since learned which ‘stoves are hot’ per-se and have learned the patterns and warning signs alerting me to their presence.

Perhaps like the analogy at the beginning of this post, my words will fall on deaf ears, and for the message to truly sink in our curiosities and desires will need to get the better of us. The lucky ones will learn this lesson quickly and react in a way to minimize the damage. Some unlucky few, like a frog in water that will be brought to a boil, will not realize the situation they are in until it is too late.

Throughout my journey to FI, it has not been entirely error free. Experiences gained over at least a decade have been one hell of a teacher and standing here now, hindsight has given me the clarity to see some of the warning signs I clearly missed. My initial mistakes were relatively minor or through dumb luck worked out somewhat favorably, but wisdom now allows me to better pinpoint many of the traps interleaved in the path to my FI goal.

I’ve learned that at least 4 words commonly pair with any attempt to separate me from my money. This does not represent a complete list, but does identify the vast majority of sticky situations in my opinion. When spoken, a signal goes off in my head that there is some clever marketing strategy in place and a deliberate attempt is underway to manipulate my emotions, all for the end goal of divesting me from my hard earned savings. Immediately my guard goes up and while I may not run away, there is a heightened sense of awareness and urgency to resist what ever is being said, because in my experience, it often doesn’t truly have my best interests in mind.

First on the list is the word deserve. This is easily one of the most common ones I see associated with any sort of dollar based purchase, upgrade, or luxury item.

– Looking for a new vehicle? You deserve the LX model!

– Working hard at your job? Well you deserve a vacation!

– Got your yearly bonus? You deserve a good night out on the town!

Nobody is immune to this line thinking and these are all examples of some of the more effective thoughts that have tried to pull me over to the dark side. Fortunately I’ve not sunk any of my money into a vacation and still drive a late-model pickup with no intentions of replacing it, but it would be untruthful to say that a few local bars didn’t have a good night because it was bonus season and I was intent on celebrating.

It’s important to remind yourself FI is a marathon and not a sprint, so when budgets allow, I recommend even the most diligent among us should still blow off some steam every once in a blue moon, and a nice steak dinner usually does it for me. After all – I’d rather enjoy the long FI ride for 12 years as opposed to bucking down and hating it for 10.

Questions may arise by this point – Why so much hate for deserve?

Because to be blunt; I believe you deserve nothing, but you can earn anything. If after a few years of 40 hour work-weeks you want to go on vacation and have the dollar amount to do so, then congratulations, you earned it. But, a vacation in itself is not indebted to you in any way. If the cost is calculated to be X and you have that same amount or more in cash, then it can be yours for the taking.

My observations has been that people like to justify some of these purchases by using equalizing variables that cannot be directly translated to whether or not they can afford it.

For example an argument may go: if we both work 2000 hours this year, we both deserve that vacation.

But what if one of us works a cash register for minimum wage, and the other is a software architect developing a new program that will be used by thousands? The measurement of an hour of time is the same for both people, but the type and impact of the work they perform varies considerably, as would the expected pay.

If only lifes pleasures could be settled up by showing a copy of your pay stub indicating solely the hours worked that week, then these arguments might make sense. Instead, dollars are the only true method to determine if something has been earned or not. Take caution any time someone tells you what you deserve.

Next up is Investment. I already know what you are thinking: Wait – This is some sort of financial independence / personal finance blog, why would ‘investment‘ be a dirty word?

My contention comes from how the term is exploited to be synonymous with “good investments“. Fact is, not all investments are good. Careers have been made rooting out the dirt from the diamonds, but as you can imagine there is still a lot more dirt than their are diamonds out there.

Finance gurus around the world scrutinize opportunities and boil them down to try and measure risk vs. reward. The best opportunities usually have a meaningful asset that can directly or indirectly provide a measurable return, often in the form of currency. Good investments are simply referred to as “investments”, and bad ones are either never mentioned and filtered out, or are just called “gambling”, and not just called “bad investments”.

A common example I see is when marketing campaigns emphasize how college is “…an investment in yourself”. Whats the return of a bachelors degree? How do you measure your combined time, efforts, and financial obligation going into this and what is your expected return as a dollar amount and figure of time spent working a new job? This sort of statement relies on how its nearly impossible to predict how a college degree will pay off, and so it forces you to make assumptions to fill in the gaps.

We assume that a “degree” is a good investment because generic overall data says college graduates make more money overall. What many people don’t think about is how much debt you may go into getting that degree, and how to factor in the lost time and wages spent working for higher education and not advancing a career through work experience over 2, 4 or more year period.

Certain financial investments are easy to identify if they are good or bad based on earnings vs risk. 100K invested in a savings account making 0.5% interest is very safe, but not a good choice if you want to use that money to make more money. That same amount invested in index funds over the long term has a high chance of going up (given enough time to weather out recessions) and on average will gain at least 7-8% of its value year over year.

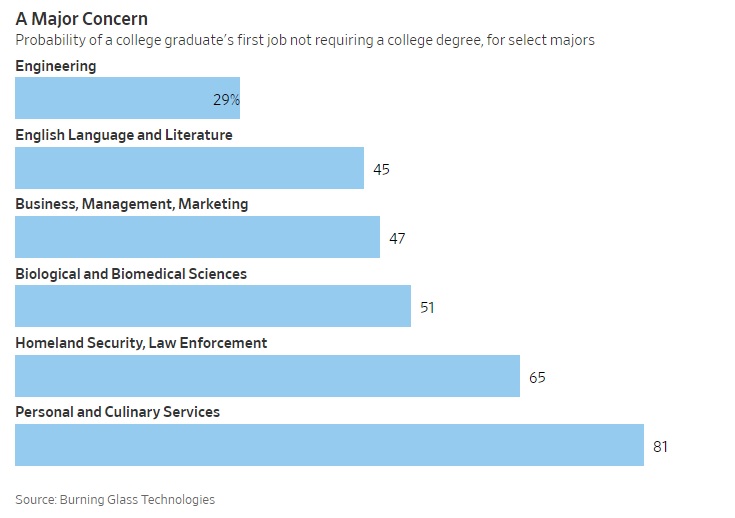

An article in the Wall Street Journal highlights how on average, 43% of graduates are underemployed (working jobs that didn’t actually require a degree). Start breaking it down by major and ‘Homeland Security/Law Enforcement’ and ‘Personal and Culinary Services’ are even worse off at 65% and 81% respectively. Engineering fares a bit better, but does not beat the average by much, with 29% of its graduates being underemployed.

Knowing some of the more ugly details, lets rephrase the proposition on how college is an investment in itself.

Here’s an “investment” that will take 4 years of your time, cost you a significant amount of money and likely put you in debt for a decade or more, and has a 43% chance of not actually being necessary for you to get your first job. The reward for this risk? you will make on average, 20% more than your non-degree’d peers if you are in that lucky 57%.

I rip on college here as an example, but this is one of many efforts that tends to abuse the term investment, and I recommend you should be on the lookout for others.

Number 3 on the list is Need. I’ve found need is interchangeable with want, and the definition of each is deliberately blurred. “You need this”, “I need that”, hell there is even a sub-reddit called “Ineeedit” with over half a million subscribers. Thats over 500,000 people willingly looking at a page full of catchy ads or items that very few of them would ever truly “need”.

The reality of life is that you need sustenance, but not a T-bone steak 2 nights a week. You need shelter, but not a 3000 sq foot “mid-sized” home with granite counter tops and fully manicured lawn. Fact is, any time someone tells me, or I tell myself that I need something, its often untrue.

Learning to balance the emotional, knee-jerk reactions to your own “needs” is difficult at first. My own example come during the purchase of my first home. The list of things I needed then was way out of line compared with my thoughts today.

I needed shelter, but wanted a larger home, and thus got stuck with high utility bills and higher taxes year over year. My need for a yard translated to a need for a lawn mower, edger, trimmer, and assorted outdoor tools else I risk a nasty-gram in the mail from the HoA. Before I knew it my needs translated to thousands of dollars in additional purchases and hours doing various bits of dirty work that have since brought me more frustration than happiness.

Lifestyle inflation is inevitable for many of us, myself included, but if left unchecked can cause your “need” list to grow dramatically and before you know it, its out of control. Everything has a hidden cost or commitment that isn’t always clear from the beginning and experience has taught me to label my needs carefully, less my hobbies end up costing more than my true necessities.

But before my rambling goes on any further, lets bring up the last word I tend to avoid, Free. For a person who regularly expounds such frugal tendencies, this seems like a contradiction to my own mantra. Craigslist has been known to reward my scavenging the free boards every now and then, but that is usually the exception.

Abuse of Free comes in a few different forms. First is when bundled with something to trick you into thinking its a good deal. For instance buying a new or used vehicle may come with a limited number of “free” oil changes. The true cost to the dealer may be only $30-40 in materials and labor, a drop in the bucket compared to the price of the original purchase. Buyers see this, plus “free” inspections, “free” floor mats, or what ever else is added, as some huge deal based on the number of line items alone and not necessarily their true cost. Never mind the fact that these could also be a great way for the dealer to find some maintenance issues that are a full-cost service and they would be happy to take care of for you while you are in.

Free games based on micro-transactions are also another form of this. The game itself is purposely designed to be addicting, yet lacking in one form or another that you can instantly fix for only a few dollars at a time. Purposely avoiding a purchase and sticking with only the free content is a good way to pass the time, but like most things on this list, my knowledge here is based on experience. Eventually a sale or just the reasoning of having so many hours invested, $5 or $10 is well worth it based on the joy it has brought. While this may be true and I do want to reward someones hard work (to create the game) every now and then, but these things can easily grow out of proportion and before you know it, the total cost is well beyond what would have been otherwise spent on a traditional item.

The other form of free comes in the form of a free product service. Experience has taught me that if a company is giving something away for free, the product is not what what is being sold, its you. You are the product for someone else’s purchase or consumption. If its a free app with no in-app purchasing, its likely designed to consolidate your data and sell it to the highest bidder.

Google and Facebook are both prime examples of this. For most users they are free to use, and what do they sell? Their users. Advertisers pay big money for the insight to provide targeted ads to specific people. Ads are adjusted based on what you search or web-pages you go to in order to have the best chance of getting you to buy something.

Like the ever-present pull of gravity constantly directing you towards the largest mass – Staying in a world full of free is difficult and unlikely to last forever, with a constant pull to purchase something. Use of these free services hones the edge the advertisers have to crack your defenses. The more you use, the more relentless they seem to be presented, never letting up. The fact of life is that you will eventually need to to buy certain things and so it would appear as they have won, and the ad cycle continues.

To sum it all up – Knowing how the game is played can let you shore up defenses or draw up a plan to lose a pawn or two instead of a queen. Going full hermit mode is not an option for many of us so learning to navigate these necessary evils will be required if you ever want to go full FI. Be cautious when offered something you Deserve or Need, take note of WHY something is an investment and ask who gains when something is Free.

Do you agree with the list? Have a list of your own? Or have you found a more effective method to avoid the ever-present temptations of consumption? Let me know in the comments.