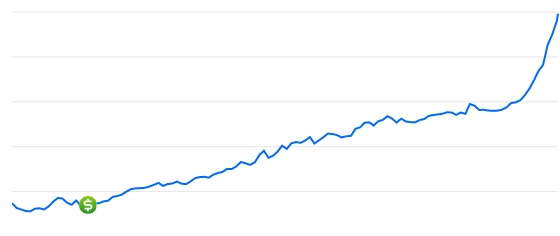

At the time of this writing – It’s the middle of 2021 and it appears a multitude of events are now converging into a common outcome; Inflation is on the rise. More specifically, and more central to this post, home inflation is setting records and leaving many wondering when, or if it will ever level out.

I know first hand of a few individuals trying to “get in” to the real-estate market who offered 20, 30, or $40 thousand dollars over asking price, and still didn’t get a home. Traditionally my real-estate market has been doing well with a slow and steady rise over time, but the effects of the pandemic have literally created a rocket-like trajectory in home values.

Many questions obviously arise from such a deviation from the norm:

– Is this the new normal and are these prices here to stay?

– Will there be a correction and this bubble is going to burst?

– Is there more to come and now is a still good time to buy?

Ultimately – Nobody knows the answer, nor can anyone accurately predict it. Instead we must all go along for the ride with our fingers crossed that whatever the outcome, it’s to our own benefit.

Looking at all of this activity, I have another question: Is home ownership a good investment?

It is inevitable that you have likely heard the phrase “home ownership is an investment”. I spoke a bit in a previous post about being extremely cautious whenever something is labeled “an investment”. The summary of my thought in that instance was that the single word “investment” has become synonymous with the term “good investment”.

Given enough time, reality teaches us that not all “investments” are good ones. You could “invest” your money into a banks savings or “investment” account earning sub-1% interest and realize very quickly its not a good return for both your money and time.

Thinking about home ownership – the word “investment” seems like a misnomer in this context. In the grandest sense, at a minimum you need three things in life; Food, Shelter, & Clothing. These all represent recurring expenses that will be with you for however long that life may be.

Knowing there is going to be a recurring cost associated with your life, it stands to reason that to maximize your net worth over time you must find a method to control and lower recurring costs to an absolute minimum (while also maintaining your sanity). If you could turn a cost area into something profitable, then it could also be considered an investment, but I would stress treating it more as a recurring cost, rather than a recurring return on my money and contributor to my net worth.

So to circle back on the thought behind this post – Do you buy a home to make money (aka: an investment), or do you buy one to control your cost of living. If your goal is to become wealthy and grow your net worth, then I think you need to look at a home as a cost-control measure, and not as an investment.

I’ll lay out my experiences that helped to shape this particular opinion.

Buying my current house seemed like a good idea based on very limited information and this sense that it was a good investment no matter what. My foresight was blinded by all of the good possibilities that could occur in my financial favor and largely or completely ignored most of my one-time costs and recurring expenses that would otherwise drag it down.

An example flaw in my logic driving this decision, was that I wanted a big house in a good neighborhood and school district because prices could only go up for something matching that criteria. After all – who would want to make 10% on $100,000 when instead you could make 10% on $300,000. Loans were dirt cheap from a percentage standpoint so it was basically like free money, or money at only 1% interest after normal inflation.

This line of thinking was entirely “investment” focused – nearly all of my thoughts and reasoning was around how to make this venture profitable, and not how much it would cost me in the long run or change my recurring cost of living to the detriment of my net worth.

Enter reality – stage right.

I moved from a rented 1200 sq. ft. two bedroom townhome to a 2500 sq. ft. four bedroom standalone monstrosity. Through my desire to make money on a live-in investment home, I nearly tripled my recurring costs and saw a huge rise in one-time spending.

Heating, cooling, and utilities for something just over double the size obviously came with a similar doubling in costs. Added to that the HOA fees were now mine alone to pay as was homeowners insurance and property taxes.

Now I had a lawn, but no lawn mower. A one time purchase fixed that problem only to discover the mower made it even more evident I didn’t own a trimmer. Again, another one-time purchase was required to fix that problem. Within a few months, the shaggy looking bushes that grew through the spring triggered yet another one-time purchase of a hedge trimmer, rake, and pitch-fork for cleaning up the yard.

I was completely caught off guard by all of the hidden costs associated with owning certain items and had never factored them into this so-called “investment”. You don’t realize until after you own your first lawn mower that you will also need a gas can to store spare fuel, tools for replacing spark plugs or changing oil, and grinders for sharpening blades.

When a light-bulb goes out in the living room its easy enough to get a chair from the kitchen to stand on and replace it. But when its the light above the two-story stairwell the chair isn’t going to cut it, and a ladder is needed.

Over the first few years the one-time purchases racked up to thousands of dollars. Multiple sized Ladders, tools, paints, fertilizer, spreaders, lawn care implements, hoses, nozzles, and that’s just the outside. An extra set of bedrooms, hallways, and bathrooms meant more decor and furnishings were needed to make it feel “like a home”. Having empty rooms and empty shelves available doing nothing meant I could fill them with costly hobby items, all of which made my wallet that much lighter. The list of things I’ve purchased to maintain my ‘investment’ seemed endless and unfortunately still grows (albeit a bit slower) to this day.

From a recurring expenses perspective – the first few years of a mortgage really don’t work in your favor to build wealth. The amortization schedule for my loan amount meant a little over $300 dollars of my $1450 payment was actually going back into my pocket. The rest, would go to someone else.

Critics frequently mention how renting is throwing money down a hole – but a decade of home ownership has taught me that this “down a hole” concept doesn’t go away once you own. Money still gets shoved down the hole, but in a like-for-like scenario the hole might just be a bit smaller if you own, but is still there none the less.

Over enough time, taxes always go up, as does insurance, utilities and your HoA fees (if applicable). Appliances break down and need replacement and overall maintenance is a constant recurring factor. Historically, selling the home means 6-8% of the price will also be lost for various fees, commissions, and general costs associated with the sale.

Now I will be the first to admit – In the current market with the home I bought, if these prices stay where they are or continue to grow then I got lucky and made some money. But if I had to to it again, or I had to buy now, with the goal of becoming a millionaire or working to grow my net worth, there is a lot I would do different.

To start – I would NOT look at a primary or live-in home as an investment that will make me money, instead, I will look at it as a cost-control measure which allows me to focus more dollars elsewhere. (*live-in home being different from a rental purchased exclusively as an investment, which I will cover another day).

I’ve not put any hard numbers into a spreadsheet to confirm, but I would make a conservative estimate that between property taxes, insurance, utilities, and general ongoing maintenance my yearly cost of living is at least $7,000. Had I went into home ownership with goals of cutting costs from the start, this number could have been easily cut in half by choosing a much smaller square footage home. Smaller size translates to cheaper taxes, lower recurring HVAC costs, and smaller ongoing maintenance.

Assuming I could cut my cost of living in half and investing the roughly $292 a month difference, over 10 years at 8% returns would be just over $53,000 – not to mention the lower overall costs means an easier loan debt to pay off and a quicker date to reach FI.

This bring me to the second, and possibly the most impactful change, I would absolutely try and buy the smallest home I could and still live comfortably, with all rooms having a clear and recurring, regular use. Reason being, the extra rooms and spaces in my current home translated to an unavoidable incentive to fill them with ‘things’.

Very often I got bored, bought something, used it for a short while and then let it collect dust. It could be decorations or hobbies doomed to fail. It all increased my one time costs while simultaneously adding to my recurring costs for things like heat/AC and the higher taxes and insurance premiums associated with the extra square footage.

Forcing yourself to do more with less can help reduce the urge to make unnecessary purchases, while also maximizing your cost cutting potential.

My third lesson learned – Land is also important – Specifically, enough that neighbors and HoA’s are not an issue. Doing it all over, having a bit more land and no HoA would have been ideal. Most people I speak with (myself included) hate their HoA. It forces you to spend extra money to maintain appearances, while also costing a direct dollar amount that is difficult to realize in a tangible way.

Its odd to think that I am paying an organization money to send me a letter in the mail threatening fines if my grass isn’t green enough or grows too high. If my bushes are not well manicured or heaven forbid – my mailbox post shows signs of flaking paint exposing the hideous and ungodly wood underneath, they have the legal authority to put a lean on my house and impose massive fines.

This fear forces me to spend extra dollars watering and fertilizing a lawn that brings me no real joy. My mailbox post plays an insignificant role in my life yet a small corner of my garage is dedicated to its yearly painting an maintenance.

By contrast, your neighbor 10 acres over won’t care if your bushes get a little overgrown, and you can always spread out with outbuildings or other hobbies if needed without fear of a nasty-gram in the mail or the ‘Karen’ next door reporting you to the board.

I also like it because it opens up opportunities to develop hobbies that further cut your costs rather than add to them, and could potentially make you money. Things like planting a garden to supplement food costs, raising chickens or other animals for eggs or meat, or using the land for things like housing honey-bee’s, producing hay, or timber farming can work to your benefit while also giving you something to do.

Tax wise, generally speaking extra property comes at a greatly reduced cost compared with large structures on that property. Similar formulas also exist from an insurance perspective. Overall, I feel the biggest bang for your buck in hindsight is land ownership and its ability to enable you to control certain costs via self sufficiency or reducing showy “appearance” requirements common to many suburbs.

Finally, I would also focus on construction materials, overall design, and longevity a bit more as a method of cost-control. For instance a single story home made of brick doesn’t require regular painting and is easy to clean without a lot of specialized tools. Compared with a two story wood-trimmed home, now extension ladders, extra long pressure washer hoses, and regular painting and rot repair are required on a regular basis.

Stones, plastics and metals that are weather resistant bring maintenance cost and weekend efforts down significantly over stained wood exposed to elements. Intelligent landscaping that practically takes care of itself is a welcome relief to anyone whose hobby isn’t gardening.

In a sense, a bigger, showy, home is like a debt with a variable rate you can’t quite predict until you actually have to start paying for it – and obviously variable rate debt is not a good option for those pursuing Financial Independence (FI).

So to summarize: Do I think of a primary home as an investment? As a self-made millionaire, having made own mistakes and getting lucky a time or two, my answer would be; no, It’s not an “investment” but rather a method of cost control for those looking to FIRE.

I do advocate in favor of ownership over renting a long period of time, since as outlined above it typically creates a smaller “hole” for which you will be throwing money into never to be seen again.

If your goal is to grow financially, or to be a millionaire at some point in the future, you should think about how the costs associated with a home will advance or slow the growth of your net worth. “Investing” in a more expensive home is unlikely to translate to a larger return on that investment due to increased costs of ownership, and may limit your ability to control other aspects of spending.

I believe in smaller, restriction free homes built with long-lived, lower maintenance materials that meet the minimum necessity for shelter. Especially those which enable you to take advantage of other resources or activities to lower total costs, and allow more investing into your net worth.

What are your thoughts? Agree with my logic? Disagree? Tell me in the comments below.