2020 was a year of extremes. It represents a monumental failure for many, but for others – it was a reincarnation of the ‘roaring 20’s’ from a century past. Businesses either boomed or went bust, people went stir-crazy quarantining at home, panic and civil unrest was rampant in our cities and towns, and for what ever reason the first thing that came to peoples mind to get them through this tumultuous time – Was to buy all the toilet paper.

Clearly – in this instance we may not have been thinking straight or perhaps someone took it literally when they heard 2020 was going to be a shit-show.

Looking back, and in full transparency- my experience was easier than most and perhaps a bit better. The “Quarantine and chill” strategy meant my spending was even less than normal after forgoing social obligations, eliminating my daily commute, and cooking all meals at home. An introverts dream, it allowed me to focus on some things I had wanted to do around the house while also forcing me to adopt a new working style that is more enjoyable than expected.

The recurring challenge for both myself and work colleagues centered around boredom. Voids that could not be filled through video games, bread making, or streaming netflix were constant.

Years ago, when my mind was made up about FI and the path to Valkyrie was ongoing, this same challenge was also present. It was further complicated by a desire to find some way to create the incremental motivation that seems ever necessary for such a long journey. Distractions can be very effective at pulling you away from the path of Financial Independence so you need to find what motivates you and ensure there is a constant stream of “wins” or something that can help pull you across the finish line

The nerdy introvert in me determined the best course of action was to opened up a spreadsheet and begin entering in all the large assets I owned line by line.

It ended up growing a bit larger than I initially thought once it was actually written down. Primary Residence, Rental Properties, Personal Bank Accounts, Rental Bank Accounts, 401k …the list went on.

Under the properties, I created dedicated columns for the outstanding mortgage balance, estimated sale value (via 3rd party websites) and calculated the resulting principal owned for each one. This amount, combined with the total value of my other accounts (HSA, 401K, bank, etc) would give me a net-worth that could itself be graphed month by month over time. Whenever I received a statement in the mail of one form or another, a line in the spreadsheet would be updated.

Having a real number in-front of me helped provide that daily (or at least monthly) motivation to continue my efforts towards Financial Independence. When the markets tanked in March, I figured it was only a matter of time before they would recover eventually. Looking back to 2000, 2008, 2012, sometimes it took a few years, but they did all recover and the market always rose to new highs not long after. With this primitive investing knowledge, I bought an array of stocks and index funds with my cash on hand and began a long waiting game.

By June – Things were already on the upswing, and my net worth was around $970,000 at the beginning of the month. While I normally try my very best (often unsuccessfully) to not keep an eye on the market day after day, I found myself refreshing pages and account statements each night trying determine when I would cross the infamous 7-figure mark. My waiting didn’t take long and by June 5th – I was a millionaire.

Thanks to market volatility it didn’t stay that way for too long, but none the less a huge mental barrier was reached that day. A celebration was in order, but not one that I could invite my friends to. Except for some very rare exceptions, my financial status would need to remain a secret to almost everyone. Reality is – both personal and professional relationships change once someone knows you “have money” and for the moment, I prefer to remain under the radar and continue the role of the poor engineer in ratty clothing.

Circling back to motivators, I thought: What’s the best method (for me at least) to celebrate this victory, while still on a budget and without too much fanfare?

In my line of work, stress consistently runs high. Healthy or not, the more common coping mechanism often involves alcohol at the end of the day. Its also sometimes used a thank you between friends. For instance, if you manage to help someone out in a tough escalation, they may say thanks with a mini-bottle of bourbon or whiskey on your desk the next morning. Offer a LOT of help, and get them promoted? A full bottle may take its place.

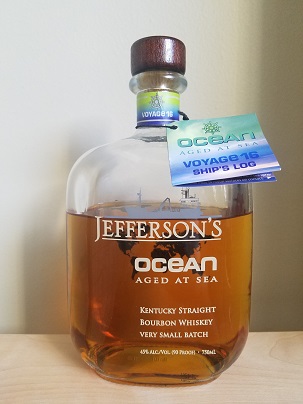

These highly prized signs of respect are sometimes saved by their owners for special occasions. One such thank you I received was a full bottle of Jeffersons Ocean. For those not aware of this particular nectar, this bourbon starts out life like any other. Its fermented from a mash of no less than 51% corn before being distilled and placed into new charred oak barrels for aging. What separates it from other bourbon, is where those barrels are aged. Its not stacked floor to ceiling in a rickhouse in the middle of the country, instead its loaded onto a ship.

This ship then sails around the world, crossing oceans and visiting continents all with its precious cargo stowed aboard. The bourbon literally becomes aged at sea during these long transits. It seemed only fitting, the methods and journey already taken by this delicious liquid should mirror one I hope to take someday soon.

Friday evening on June 5th – I cracked open the cork and celebrated this incredible milestone in the company of my dog and a single ice cube. It would mark one of the few positives that graced its presence during 2020.

No less than a few months later, and my company would announce a billion dollars in expense cuts were to follow. Before the quarter was out, my manager, and a good portion of my team, were gone. If Financial Independence was a ‘nice-to-have’ before, this experience affirmed its position as a necessary requirement for the years to come.

Rubble left behind in 2020 looks like it may become a good foundation for 2021 to build on top of. My financial outlook retains some cautious optimism that things will continue to improve. I have no facts or formal education to back that statement up however, its more of a wish at this point than actual commentary.

When it comes to lessons learned, there are some habits I will be sticking with which seem like they work best for me.

- Keep regular milestones to maintain motivation

- Celebrate the big ones with something you have been saving specific to them.

- Find an outlet (like an FI blog!) that helps pass the time at minimal expense.

For now – I will continue to maintain my spreadsheet, writing what comes to mind, and keep a hopeful eye on a few more unopened bottles nestled away in my liquor cabinet. Each one representing another big milestone, and one that represents a finish line.

I am curious to hear – What does your milestone celebration look like? or do you even have one? Leave me a comment below.