Lets cut right to the chase – Today, I can purchase a brand new Lamborghini Aventador, all cash, no debt. How? The plan is easy, but is not quick, and is hard to follow for most people, thus it remains an elusive purchase. There’s no multi-level marketing, no get rich quick schemes, and nothing to buy. Just 3 steps really.

- Save at least 50% of every dollar you make

2. Invest that savings

3. Wait and repeat (years if necessary)

The last step usually is where most people fall off and stop reading. Lets face it, if you are 22 and just out of college, you want to drive a new super-car by 23, not necessarily wait until your 30s or 40s. Unless you win the lotto or manage to post a few viral videos that really take off, its unlikely you will ever see one in your 20s, but if its important and a long term goal for you, it is possible to do it in your 30s if you save and wait enough. How exactly did I do it? Patience, time, and a high investment ratio.

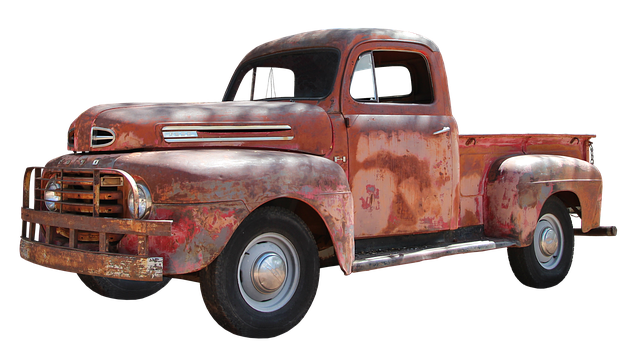

Don’t get me wrong, as much as I take pride in driving my late-model pickup for its various charms (low cost of maintenance, lack of deprecation, and general utility) it would be a lie to say I didn’t sometimes fantasize about something bigger, better, newer, or just with more horse-power. But…I’ve always opted to hold and not sell my investments, and its paid off for the most part.

I remember a discussion with a work colleague a while back about the benefits of saving and investing (not necessarily related to FI) and one comment he said resonated with me. Talking about how my investments were seeing fantastic returns up to that point, he commented: “…yeah but when do you see some meaningful return?”

“Meaningful” – I know exactly what he meant. If you get 10% gains over a year, on a thousand dollar investment; you have enough to pay for a dinner for two, not very impressive. The same percentage on 50k and its enough to buy a fancy new appliance or two. Started with a cool million? Now you’re talking about like having a second (very healthy) salary. The percentage is the same in all scenarios, but the money it provides can offer some drastically different opportunities.

So how do you define “meaningful”? The exact amount may be different for every person, and if you are still early on in your savings its unlikely the recurring safe withdrawal rate will translate to anything very interesting. With my net-worth growing, and using index funds in my taxable account as a savings vehicle, it became a fun mental game to see what my gains could afford if I decided to sell it all and buy something in cash.

Years ago was when it first became apparent. Browsing classic cars online was a old 1930s chevy that looked awesome. With an asking price of $35,000 I realized….I could afford that. Straight cash, walk in, hand them a check and walk out with keys.

The thought of owning a cool classic car stuck around my head for weeks. Granted this was before my mind was really made up on why I was saving, I was just saving for “something”. Running the numbers for insurance, taxes and maintenance, it all worked out, so technically speaking I could afford it.

The biggest problem holding back my decision, was that there was no place to store a new vehicle, or at least not inside. Plus the thought of handing all that cash over for a material purchase was a bit frightening and put a knot in my stomach knowing how long it took to earn it all. Hindsight taught me that’s likely a good thing and one of the reasons I prefer to use cash today. It helps deter larger, unnecessary purchases through my natural reluctance to hand over my hard-earned dollars.

Continuing the journey the next few weeks – Frugalness and logic eventually won out and I decided against it. My investments would stay the course and be allowed to ebb and flow with the tides of the market. As months turned into years, the purchasing power available to me became more impressive. That 1930’s hot rod now could have been a brand new, heavy duty diesel pickup for 70 grand. All top of the line, with no expense spared, it could have been mine for all cash.

But if 35 grand for a toy was out of line, doubling that amount for a new work pickup was nowhere near the realm of possibility, so again my savings strategy remained, and my investments grew.

The importance of diversification was taught to me a bit later in life, so a few years later my goals later shifted to expanding my rental portfolio. Now instead of a pickup, I could instead get a sizable down-payment on a house, or buy it all cash. Now we’re talking some meaningful, and income providing! Even better, it directly fits into my FI goals which were solidified by this point. Without expanding this post into my rental purchase decision making, long story short I generally hold out a while looking for the “right” property for me.

After about a year of searching, a series of lucky or unlucky events happened. Or, something like that, not sure how to classify it yet. I chock it up to the “Opportunity windows” that grace us all from time to time and so far I’ve ended up on top, so perhaps lucky is the best term.

In late 2019 a property appeared that fit all the checkboxes for my investment decision making. My accounts had enough for me to sell my long term investments, plus add some cash on hand, to buy it outright. Everything was looking great, until the deal fell through. Given it wasn’t my fault I remained largely unscathed. The only real cost was the result of resetting the clock on my realized gains when I sold.

Its now late 2019 and here I am with about a quarter million in cold hard cash across all my accounts (after taxes) after a bit over 5 years of hardcore saving & investing – not too shabby. If my goal was to buy something nice, this could have been the time. A used Lambo, Mclaren, or any new truck I wanted. But as mentioned above, those were not my goal (but they could be yours). There was a chance the deal could come back on the table, or that another property I was looking at could show up so I stayed with the liquid assets for the short term and to simplify my taxes closing out 2019.

We all know what happens next – fast forward a few months and a global pandemic sets in. The markets tank, and I still have all that cash. Though luck alone I bought at the low and have been riding up with the market, seeing double-digit gains in less than a years time. My buy-and-hold strategy means they will eventually become long-term capital gains for the tax advantage. At the time of this writing, my investments have nearly doubled, and anything I was holding that sunk before has already recovered or exceeded its pre-pandemic levels.

Lets acknowledge that from an investment standpoint – 2020 was a good, lucky year for me. If I wasn’t in a cash position I would not have sold any of my assets and would have otherwise broke even on growth that year. Some reading(or listening) this post would see it as the ”false” or “weak-link” in my plan to encourage others to save, the same way the stereo-typical trust-fund kid talks about how a scant – 500 thousand dollar investment from their parents helped them become a millionaire and you could do it too!

Instead, my disclosure here is intended to remain transparent, truthful, and show that sometimes a bit of luck (coupled with your ability to remain open to opportunities as they arise) can help accelerate things quicker than you hoped. Pre-2020, my savings were at over a quarter million, and if nothing changed would still be worth that or more today once everything largely recovered – So the strategy works, but if my goal was half a million for a new super-car I estimate it would have taken another 3-5 years at my current return and savings rate. Instead, it was bumped to 1.

If you are reading this and just starting your journey, looking for inspiration, or are well on your way already, my advice would be do what ever is necessary to stay the course. Have a mental (or even a real printed) picture of what your future is like, something strong enough to help fight off the poor financial impulses that plague us all in day to day life. Know that sometimes things come along that can either speed up or slow down the journey, but not stop it entirely. I am certain there will be another big bump in the road similar to 2020, hopefully many years down the road but in retrospect they happen all the time. Recessions, housing crises, and bubbles of all sorts. Sometimes you may find yourself in a position to take advantage of them, other times you just need to ride out the storm.

Remember – Stay the course!